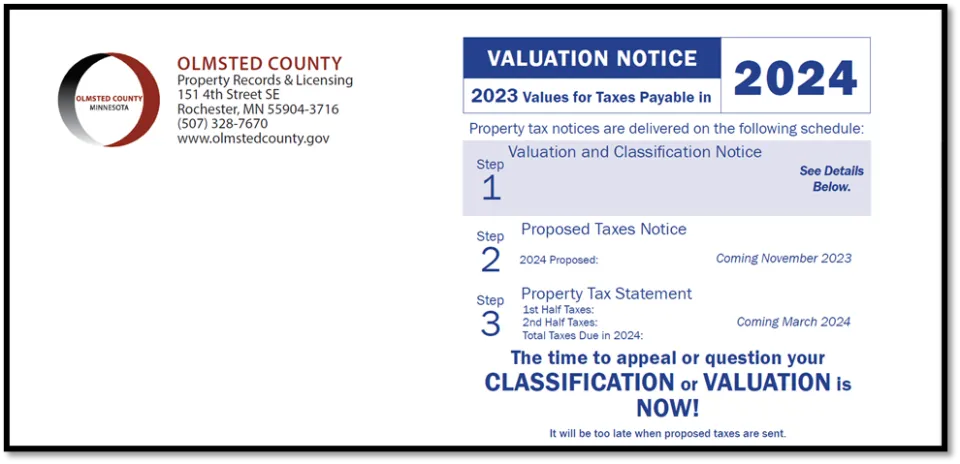

Process in Olmsted County for appealing 2023 assessed property valuation and/or classification

Recently, a notice was mailed to Olmsted County property owners regarding the 2023 assessed value and/or classification of their property. Southeast Minnesota, including Olmsted County, saw average residential value increases between 4% and 15%.

If property owners do not agree with their Estimated Market Value, they are encouraged to follow these steps to begin the appeal process:

- Contact the Olmsted County Assessor’s Office.

- Collect documentation to support your opinion. Examples include, a recent appraisal, recent sale of like property, recent change in revenue, etc.

- Call 507-328-7670.

- Visit the Assessor’s Office located at 151 4th Street SE in Rochester, 8 a.m. – 5 p.m., Monday through Friday.

- If property owners are not satisfied after their discussion with the Olmsted County Assessor’s Office, they are welcome to attend the appropriate meeting of their Local Board of Appeal and Equalization (LBAE) or the Open Book meeting listed on their Valuation Notice. Go to the Olmsted County Website and select “If the issue is not resolved” for more information on meeting dates and times. If a meeting is not offered in your jurisdiction, please call 507-328-7670.

- Attend the County Board of Appeal and Equalization (CBAE) meeting at 7 p.m. on Tuesday, June 20, 2023. Residents should call 507-328-6001 to make an appointment for the meeting. Property owners must have attended a local board of appeals meeting or call 507-328-7670 if a meeting is not offered in their jurisdiction, prior to attending the county board of appeals. If your jurisdiction has an open book meeting, you may appeal directly to the county board of appeals.

- A property owner’s final avenue to appeal is to petition the Minnesota Tax Court. Tax petitions may be filed after the valuation notice is received and before April 30 of the year the taxes are payable (appeals of 2023 assessed values may be filed in Minnesota Tax Court until April 30, 2024). For more information, visit the Minnesota Tax Court website or call 651-539-3260.

Questions?

For more information on property assessments, including house value, estimated market value, and how to appeal an assessment, please visit Olmsted County’s website or call 507-328-7670.